为行业带来有价值的变化

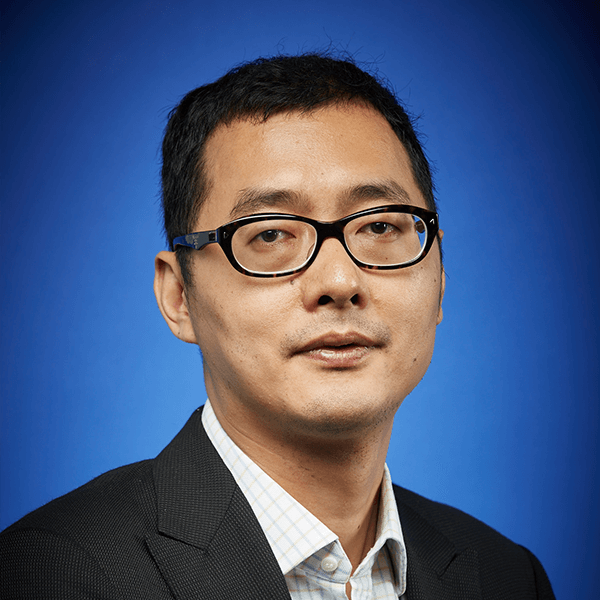

在为行业提供了十年的咨询服务之后,2018年我创建了埃尔坡,当时的想法只有一个,那就是专注于行业里的“真问题”,提供真正有价值、确实能够让问题得以消除的专业服务。这样的真问题,在我看来只有从实际的业务活动中抽离出来,站在更抽象的视角下才能显见出来。

埃尔坡的名字来自“AIRPO”的音译,为的是标明我们服务机场行业的心迹。比“AIRPORT”少掉两个字母, 是因为我们认为数字化就是用“解构”的方式,对物理世界的生产要素进行全新重组,让管理和经营活动在数字世界里“被掰开揉碎”,却又能得到系统性地刻画和处理,从而使得管理决策者能够更加快速、全面地洞察事实本原,掌握实际业务的内在逻辑和本质。依托于数字化工具呈现的 “ 真知灼见”,我们深信机场行业绝 大多数管理和经营问题都可以得到彻底的改变。

如果说数字化让机场“灵动轻盈”(Flexible),那么资本化则让机场能够“流动起来”(Flow)。作为重资产的公共交通基础设施,机场的管理主体天生就重担在肩。我们相信机场与金融市场的紧密结合,可以为行业带来更强劲的发展动力。过去的二十多年间,自厦门机场在1996年首次亮相资本市场之后,陆续有上海、北 京、广州、深圳,以及海口等5个城市的机场分别在上 交所、深交所和港交所上市,而且也有不少机场筹划试图进入资本市场。不过,截至目前,国内机场的资本化程度依然很低。我们相信,不管是类似IPO这样的股权融资,还是信用类、资产类的债权融资,抑或是股权改革和业务重组,机场这样的优质国有资产在资本化证券化的道路上都大有可为。我们坚信,以市场的逻辑、资 本的力量和金融的手法来推动实现资本化与证券化,可以为机场的高质量、可持续健康发展,以及参与全球竞 争,提供更加全面、系统地支撑。

对行业来说,埃尔坡带给客户的是两个最具影响力的顶层视角——数字化和资本化。我们坚信,科学、领先的认知,辅以安全有效的实现方式和路径,一定能够为行业带来有价值的变化。中国机场在“智慧”和“资本” 的双重加持之下,也必将迎来蓬勃兴盛的繁荣时代。

After a decade of airline consulting experience, I founded AIRPO in 2018 with one single idea: to focus on the “real problems” in the industry and provide professional services that are truly valuable and effective. Such real problems, in my opinion, can be revealed only when actual business activities are left apart and a more abstractive perspective is adopted.

Our name “AIRPO” marks our commitment to serving the airport industry. It is two letters fewer than “AIRPORT” because we believe that digitalisation restructures factors of production in the physical world through “destruction” and triturates management and operation activities while receiving systematic characterisation and processing, thereby presenting decision makers with swifter and more comprehensive insights and grasping the business logic and nature. With the assistance of digitalisation tools, we hold most management and operational problems in the airline industry can be completely remedied.

While digitalisation makes airports Flexible, capitalisation helps them Flow. As a heavy asset of public transportation infrastructure, airport management subjects are born with an important duty. We believe the close integration of airports and the financial market can bring stronger impetus to the industry. In the past 20 years, since Xiamen Airport made its debut in the capital market in 1996, airports in Shanghai, Beijing, Guangzhou, Shenzhen and Haikou have gone public the Shanghai, Shenzhen, and Hong Kong Stock Exchange, with far more to go. Domestic airports remain undercapitalized; however, despite the fact that high-quality state-owned assets like airports possess promising futures in capitalisation and securitisation via equity financing like IPOs, debt financing with credits and assets, or restructuring. We hold that market-driven capitalisation and securitisation with the power of capital and financing methods can provide airports with more comprehensive and systematic supports toward high-quality and sustainable developments and global competition.

For the industry, AIRPO brings clients two of the most powerful top-level perspectives—digitalisation and capitalisation. We firmly believe that scientific and advance know-hows, backed by safe and effective implementations, would definitely bring valuable alterations to the industry. With the dual support of wisdom and capitals, Chinese airports will surely usher in a prosperous era.